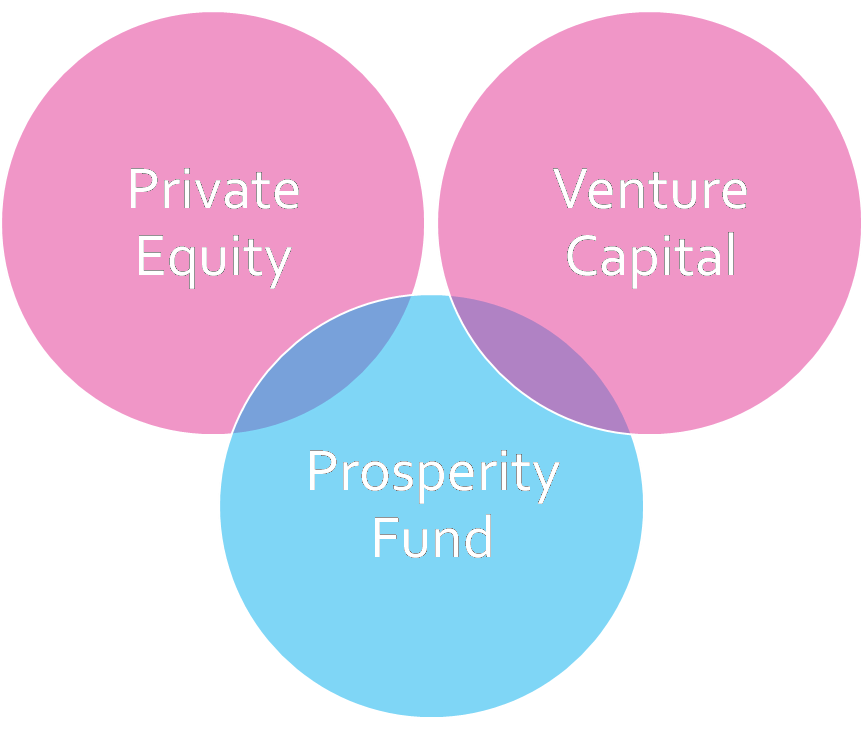

Private Equity

Private Equity Investment Assets

Venture Capital

OVERVIEW OF ASSET CLASSES

- Private Equity Investment Assets: Gov-Con, Technology, Healthcare, Quantum Computing, Artificial Intelligence, Cybersecurity, & FinTech

- Venture Capital Investment Opportunities: Seed, Early Stage, & Growth Investments

The Prosperity Fund’s Growth Potential

Investors will have the opportunity to invest in the select investment categories above or in a basket of these asset classes together.

Our Fund will be available to funds, institutions, endowments, companies, private family offices, & other accredited investors. We anticipate competitive returns and diversification at the frontier of emerging technologies and cutting-edge investment assets.

PRIVATE EQUITY

Basket of select Private equity investment opportunities in key industries, including, Tech, Government defense contracting, Healthcare, Quantum Computing, Artificial Intelligence, Cybersecurity, FinTech, & Other Growth-oriented private industries.

Leveraging our key industry contacts, we May access various mergers and acquisition deals in both middle and large markets, allowing us to buy in early.

Projected Timeline: 2-5 Year Horizon

Projected Returns: 3-10X+ Multiple

Venture Capital

VC Investments: Pre-seed, Seed, Early-Stage, & Growth.

Investments in unique & disruptive technologies in technology, quantum computing, artificial intelligence, cybersecurity, healthcare, fintech, and other key industries.

Fintech: Cutting edge tech in business, payments, & more.

Projected Timeline: 3-5 Year Horizon

Projected Returns: 5-25X+ Multiple